Soxl Stocktwits

Overview – What’s SOXL All About?

Hey there! Have you ever heard of SOXL? It’s like a supercharged version of regular stocks. Imagine if you could take a standard stock and give it superpowers – that’s kind of what SOXL is! It’s called a “leveraged ETF,” which is a fancy way of saying it tries to multiply the moves of semiconductor stocks by three. So, if semiconductor stocks go up a little, SOXL tries to go up a lot. But watch out! If those stocks go down, SOXL can fall even faster. It’s like riding a rollercoaster – super exciting but not for the faint of heart!

Key Stats

Here’s a quick look at some significant numbers for SOXL:

| Stat |

Value |

| Volume |

85.342M |

| Market Cap |

12.625B |

| ATR14 |

$3.27 (9.30%) |

| P/E Ratio |

N/A |

| Beta |

4.63 |

| Dividend Rate |

N/A |

| Fair Opening Price |

$35.27 |

Don’t worry if some of these terms sound gibberish – even grown-ups sometimes scratch their heads over this stuff!

Soxl Stock price prediction 2025

The Direxion Daily Semiconductor Bull 3 X Shares (SOXL) stock price forecast for the next 30 days is generally positive, with an average analyst price target of $139.93, representing a +433.07% increase from the current price of $26.25. The highest analyst price target is $218.21, and the lowest is $61.65.

Note: Our forecast model does not currently account for dividend and stock split events. This means that our forecast may not be accurate for stocks that have recently experienced either of these events.

Green day on Thursday for SOXL

Guess what? Thursday was a good day for SOXL! It’s like playing a video game, and your character levels up. The price of SOXL went from $34.96 to $35.21. That might not sound like much, but remember, even small changes can be a big deal in the stock market.

During the day, SOXL was bouncing around like a pinball. It went as low as $33.98 and as high as $36.61. That’s a pretty big range! Imagine if your height could change that much in one day – you’d be taller than a basketball hoop one minute and shorter than your little sister the next!

More people were buying and selling SOXL than usual, too. Eighty-five million shares changed hands. That’s like if everyone in Germany decided to trade something on the same day!

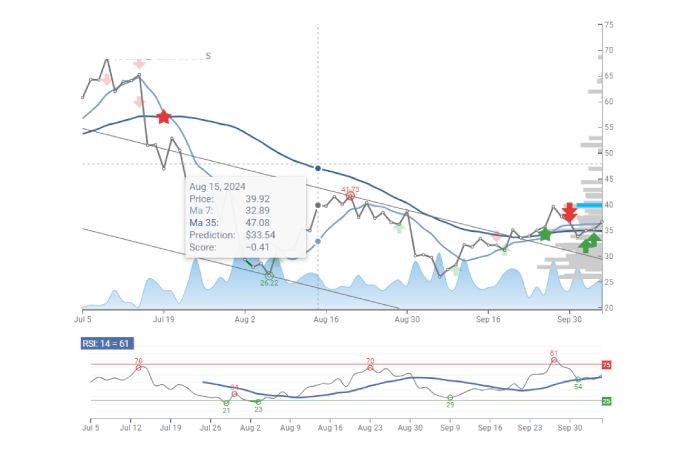

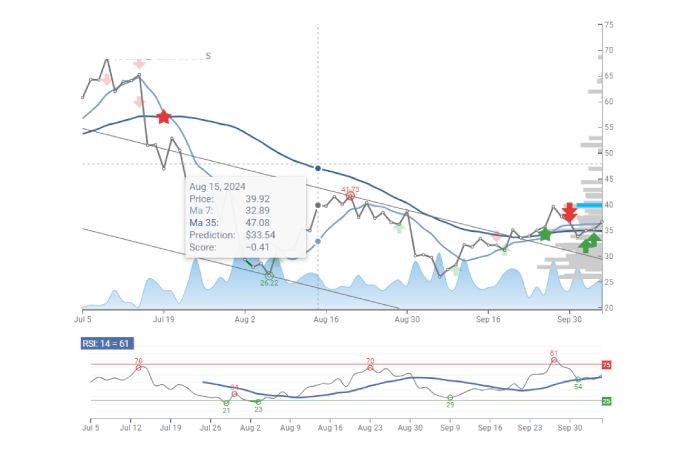

SOXL Signals & Forecast

Okay, so here’s where it gets a bit tricky. Imagine you’re trying to predict the weather. Sometimes you look at the clouds and think it’s going to rain, but then you check the temperature, and it feels like a sunny day is coming. That’s what’s happening with SOXL right now.

Some signs say its price might drop soon, but others say it might go up. It’s like SOXL is playing tug-of-war with itself!

One thing to watch out for is the price of $36.24. If SOXL goes above that, it could be a good sign. But if it falls below $34.99, that might mean trouble ahead. It’s like having a secret map with treasure above one line and dragons below another!

Support, Risk & Stop-loss for SOXL ETF

Alright, let’s talk about safety nets. You might use training wheels when you’re learning to ride a bike. In the stock market, we have something similar called “support levels.”

For SOXL, there’s a safety net of around $34.96. It’s like a trampoline – if the price falls to that level, it might bounce back up. But remember, sometimes trampolines break!

Here’s the scary part: SOXL is considered “high risk.” It’s like going on the most significant, craziest rollercoaster at the amusement park. Sure, it’s exciting, but it’s not for everyone. In just one day, the price increased by $2.63. That’s a lot of movement!

Trading Expectations (SOXL) For The Upcoming Trading Day Of Friday 4th

Let’s put on our fortune-teller hats and try to guess what might happen on Friday. We think SOXL might start the day at $35.27. During the day, it could go as low as $31.94 or as high as $38.48. That’s a pretty extensive range!

Here’s a fun way to think about it: imagine SOXL is a jumping frog. On Friday, we believe it might jump about 9.30% up or down from where it started. That’s a pretty big leap for a frog!

Is Direxion Daily Semicondct Bull 3X ETF ETF A Buy?

So, should you buy SOXL? If SOXL were a video game, right now, it might be on “hard mode.” There are some warning signs that it might not do so well shortly.

Remember, buying stocks is a bit like betting on a sports team. Sometimes, even the best teams have a terrible season. Right now, it looks like SOXL might be having one of those rough patches.

Don’t let that get you down! The stock market is constantly changing, and who knows what might happen next? The most important thing is to learn, have fun, and never invest more than you can afford to lose. After all, it’s not just about making money – it’s about understanding how this crazy, exciting world of stocks works!

Soxl Stocktwits Buy Or Sell

Alright, let’s discuss the big question: Should you buy or sell SOXL? It’s like trying to decide whether to trade your favorite trading card—it’s not always an easy choice!

On Stocktwits (which is like a clubhouse for stock fans), people are pretty split about SOXL. Some folks are super excited and think it’s going to skyrocket. They’re like, “To the moon!” Others are more worried and think it might be time to cash out.

Remember how we said SOXL is like a rollercoaster? Well, some people love rollercoasters and want to ride them all day, while others prefer the merry-go-round. It depends on how much excitement (and risk) you’re comfortable with.

My advice? Don’t just follow what others say. You must do your homework and decide what’s best for you. And always remember – never invest more than you can afford to lose!

SOXL Reddit

Now, let’s take a trip to Reddit—it’s like the Wild West of the internet, especially when it comes to stocks!

On Reddit, there are whole communities (called subreddits) dedicated to discussing stocks like SOXL. It’s like a big, never-ending conversation. Some people share detailed analyses (like book reports, but for stocks). Others just post funny memes about the market’s ups and downs.

One cool thing about Reddit is that you can see different points of view. Some Redditors are SOXL superfans, while others think it’s too risky. Reading through these discussions can be helpful, but remember – not everyone on the internet is an expert!

Just like with Stocktwits, it is essential to take what you read on Reddit with a grain of salt. Use it to learn and get ideas, but always double-check information and make decisions.

Soxl Stocktwits News

Keeping up with news about SOXL is like being a detective—you have to look for clues everywhere!

On Stocktwits, people are always sharing the latest news about SOXL. Sometimes, it’s big stuff, like changes in the semiconductor industry (the tech SOXL is tied to). Other times, it might be about general market trends affecting SOXL.

There’s been a lot of buzz recently about new computer chip factories being built. This is big news for SOXL because it’s all about semiconductor companies. Some people think this could increase SOXL, while others aren’t so sure.

Remember, news can change fast in the stock world. What’s hot today might be old news tomorrow. It’s like trying to keep up with the latest video game trends – exciting but sometimes overwhelming!

Soxl Stocktwits Dividend

Okay, let’s talk about dividends. Think of dividends like a bonus you might get for doing chores – some stocks give you a little extra money just for owning them.

But here’s the thing about SOXL – it doesn’t pay dividends. It’s like that friend who never shares their candy. But before you get disappointed, remember that SOXL is designed differently.

Instead of paying dividends, SOXL aims to grow in value really fast. It’s like choosing between getting a dollar every week or the chance to get ten dollars all at once. SOXL is going for that big growth, so it doesn’t bother with small dividend payments.

You might see people talking about this on Stocktwits. Some wish SOXL would pay dividends, while others are happy with the potential for big gains. It’s all about what you prefer—steady small rewards or the chance for a big win.

Feel free to jump to any section you’re curious about. Remember, learning about stocks is a journey, not a race. Take your time, ask questions, and most importantly, have fun exploring this exciting world of finance!

Is Direxion Daily Semiconductor Bull 3 X Shares (SOXL) A Buy Now?

Oscillators

| Name |

Value |

Action |

| RSI(14) |

42.70 |

Neutral |

| STOCH(9,6) |

19.96 |

Buy |

| STOCHRSI(14) |

16.96 |

Buy |

| MACD(12,26) |

-0.9402 |

Sell |

| ADX(14) |

14.66 |

Neutral |

| William %R |

-79.84 |

Neutral |

| CCI(14) |

-68.69 |

Neutral |

Buy: 2Sell: 1Neutral: 4

Summary: Neutral

Moving Averages

| Period |

Simple |

Exponential |

| MA10 |

28.49

Sell |

27.62

Sell |

| MA20 |

29.44

Sell |

28.58

Sell |

| MA50 |

29.15

Sell |

29.72

Sell |

| MA100 |

31.63

Sell |

31.90

Sell |

| MA200 |

38.36

Sell |

33.17

Sell |

Buy: 0Sell: 10Neutral: 0

Summary: Sell

According to our latest analysis, SOXL could be considered a Strong Sell, with 18 technical analysis indicators signaling 2 Buy signals, 11 signaling Sell signals and 4 Neutral signals. This might not be a good time to consider opening new positions on SOXL, as trading bearish markets can be challenging and may result in losses.

RSI (Relative Strength Index): The RSI(14) value of 42.70 indicates that SOXL is neither overbought nor oversold. It suggests a neutral sentiment in the short term.

STOCH (Stochastic Oscillator): The STOCH value of 19.96 indicates that SOXL is oversold. This indicates that SOXL price is at or near the lowest level over a specified lookback period.

STOCHRSI (Stochastic Relative Strength Index): The STOCHRSI value of 16.96 indicates that SOXL is oversold. This suggests that SOXL price is at or near the lowest level relative to its recent price history.

ADX (Average Directional Index): The ADX value of 14.66 suggests that there may be some movement in price, but it lacks strength or conviction.

CCI (Commodity Channel Index): A CCI(14) value of -68.69 indicates that SOXL is still oversold but not to an extreme extent.

Long-term SOXL price forecast for 2025, 2030, 2035, 2040, 2045 and 2050

Based on our analysis about Direxion Daily Semiconductor Bull 3 X Shares financial reports and earnings history, Direxion Daily Semiconductor Bull 3 X Shares (SOXL) stock could reach $131.81 by 2030, $128.46 by 2040 and $315.29 by 2050. See the projected annual prices until 2050 of the Direxion Daily Semiconductor Bull 3 X Shares stock below:

Direxion Daily Semiconductor Bull 3 X Shares (SOXL) is expected to reach an average price of $49.63 in 2035, with a high prediction of $60.29 and a low estimate of $50.27. This indicates an +89.05% change from the last recorded price of $26.25.

Direxion Daily Semiconductor Bull 3 X Shares (SOXL) stock is projected to chart a bullish course in 2040, with an average price target of $129.01, representing an +391.47% change from its current level. The forecast ranges from a conservative $129.77 to a sky-high $128.46.

Our analysts predict Direxion Daily Semiconductor Bull 3 X Shares (SOXL) to change +760.93% by 2045, soaring from $226.32 to an average price of $225.99, potentially reaching $226.18. While $226.32 is the low estimate, the potential upside is significant.

The Direxion Daily Semiconductor Bull 3 X Shares (SOXL) stock is expected to climb by 2050, reaching an average of $310.11, a +1081.35% change from its current level. However, a wide range of estimates exists, with high and low targets of $315.29 and $315.74, respectively, highlighting the market’s uncertainty.

Direxion Daily Semiconductor Bull 3 X Shares Stock (SOXL) Year by Year Forecast

Direxion Daily Semiconductor Bull 3 X Shares Stock (SOXL) Price Forecast for 2025

The Direxion Daily Semiconductor Bull 3 X Shares Stock (SOXL) is expected to reach an average price of $114.41 in 2025, with a high prediction of $227.82 and a low estimate of $1.0003. This indicates an +335.84% rise from the last recorded price of $26.25.

| Month |

Average |

Low |

High |

Change from today’s price |

| March, 2025 |

$77.57 |

$61.65 |

$218.21 |

+195.52% |

| April, 2025 |

$13.79 |

$11.37 |

$127.53 |

-47.48% |

| May, 2025 |

$14.74 |

$2.9217 |

$25.87 |

-43.84% |

| June, 2025 |

$15.71 |

$1.0003 |

$41.05 |

-40.14% |

| July, 2025 |

$77.21 |

$24.73 |

$97.31 |

+194.14% |

| August, 2025 |

$106.06 |

$59.16 |

$111.71 |

+304.03% |

| September, 2025 |

$139.16 |

$83.87 |

$151.42 |

+430.12% |

| October, 2025 |

$147.33 |

$120.39 |

$211.72 |

+461.27% |

| November, 2025 |

$154.86 |

$109.75 |

$162.65 |

+489.95% |

| December, 2025 |

$152.31 |

$143.46 |

$227.82 |

+480.22% |

Direxion Daily Semiconductor Bull 3 X Shares Stock (SOXL) Price Forecast for 2026

The predicted value for Direxion Daily Semiconductor Bull 3 X Shares (SOXL) in 2026 is set at an average of $330.40. Estimates vary from a peak of $626.83 to a trough of $33.97, indicating an +1158.68% surge from the present price of $26.25.

| Month |

Average |

Low |

High |

Change from today’s price |

| January, 2026 |

$295.95 |

$150.05 |

$303.77 |

+1027.42% |

| February, 2026 |

$358.51 |

$284.05 |

$389.79 |

+1265.74% |

| March, 2026 |

$475.84 |

$328.86 |

$531.56 |

+1712.71% |

| April, 2026 |

$595.00 |

$396.12 |

$626.83 |

+2166.67% |

| May, 2026 |

$54.89 |

$57.24 |

$583.42 |

+109.10% |

| June, 2026 |

$43.80 |

$46.21 |

$51.08 |

+66.85% |

| July, 2026 |

$54.67 |

$47.31 |

$50.60 |

+108.28% |

| August, 2026 |

$45.86 |

$47.96 |

$50.93 |

+74.72% |

| September, 2026 |

$41.82 |

$41.79 |

$43.33 |

+59.31% |

| October, 2026 |

$35.62 |

$38.64 |

$41.07 |

+35.69% |

| November, 2026 |

$34.36 |

$35.54 |

$38.15 |

+30.89% |

| December, 2026 |

$39.23 |

$33.97 |

$32.72 |

+49.46% |

Soxl Stocktwits – Direxion Daily Semiconductor Bull 3 X Shares Stock (SOXL) Price Forecast for 2027

For 2027, Stockscan’s Analyst expects the average price target for Direxion Daily Semiconductor Bull 3 X Shares (SOXL) is $28.55, with a high forecast of $50.73 and a low forecast of $6.3797. This indicates an +8.77% increase from the last price of $26.25.

| Month |

Average |

Low |

High |

Change from today’s price |

| January, 2027 |

$33.90 |

$37.45 |

$38.20 |

+29.16% |

| February, 2027 |

$7.9445 |

$15.29 |

$29.91 |

-69.74% |

| March, 2027 |

$15.92 |

$12.99 |

$6.5446 |

-39.35% |

| April, 2027 |

$9.0598 |

$6.3797 |

$5.7947 |

-65.49% |

| May, 2027 |

$28.74 |

$29.80 |

$27.78 |

+9.49% |

| June, 2027 |

$35.76 |

$32.30 |

$29.35 |

+36.21% |

| July, 2027 |

$30.41 |

$30.77 |

$34.53 |

+15.83% |

| August, 2027 |

$43.40 |

$34.23 |

$39.34 |

+65.32% |

| September, 2027 |

$40.91 |

$45.37 |

$43.93 |

+55.85% |

| October, 2027 |

$51.13 |

$42.09 |

$47.40 |

+94.78% |

| November, 2027 |

$49.58 |

$51.16 |

$50.73 |

+88.88% |

| December, 2027 |

$40.22 |

$43.12 |

$48.01 |

+53.20% |

Soxl Stocktwits – Direxion Daily Semiconductor Bull 3 X Shares Stock (SOXL) Price Forecast for 2028

In 2028, Direxion Daily Semiconductor Bull 3 X Shares (SOXL) is projected to reach an average price of $35.71, with a high projection of $49.49 and a low estimate of $21.94. This indicates an +36.05% rise from the last price of $26.25.

| Month |

Average |

Low |

High |

Change from today’s price |

| January, 2028 |

$47.62 |

$42.77 |

$46.34 |

+81.39% |

| February, 2028 |

$50.28 |

$48.07 |

$48.78 |

+91.53% |

| March, 2028 |

$48.54 |

$48.71 |

$49.49 |

+84.92% |

| April, 2028 |

$43.26 |

$44.38 |

$47.36 |

+64.81% |

| May, 2028 |

$44.68 |

$43.15 |

$43.18 |

+70.20% |

| June, 2028 |

$40.32 |

$41.49 |

$44.28 |

+53.59% |

| July, 2028 |

$35.97 |

$36.52 |

$37.82 |

+37.02% |

| August, 2028 |

$36.04 |

$36.28 |

$35.76 |

+37.30% |

| September, 2028 |

$33.09 |

$33.64 |

$32.86 |

+26.06% |

| October, 2028 |

$32.94 |

$33.38 |

$32.71 |

+25.49% |

| November, 2028 |

$23.72 |

$24.91 |

$32.38 |

-9.65% |

| December, 2028 |

$19.57 |

$21.94 |

$21.91 |

-25.46% |

Soxl Stocktwits – Direxion Daily Semiconductor Bull 3 X Shares Stock (SOXL) Price Forecast for 2029

The 2029 price forecast for Direxion Daily Semiconductor Bull 3 X Shares Stock (SOXL) is $28.98 on average, with a high prediction of $57.30 and a low estimate of $0.6564. This represents an +10.39% increase from the previous price of $26.25.

| Month |

Average |

Low |

High |

Change from today’s price |

| January, 2029 |

$14.31 |

$14.77 |

$18.31 |

-45.48% |

| February, 2029 |

$20.72 |

$18.32 |

$18.76 |

-21.06% |

| March, 2029 |

$20.25 |

$17.20 |

$17.73 |

-22.85% |

| April, 2029 |

$19.72 |

$20.25 |

$19.71 |

-24.86% |

| May, 2029 |

$16.43 |

$19.30 |

$22.59 |

-37.42% |

| June, 2029 |

$12.62 |

$13.85 |

$13.40 |

-51.93% |

| July, 2029 |

$2.9484 |

$3.4584 |

$11.31 |

-88.77% |

| August, 2029 |

$0.5735 |

$0.6915 |

$6.5215 |

-97.82% |

| September, 2029 |

$8.8364 |

$0.6564 |

$11.35 |

-66.34% |

| October, 2029 |

$16.77 |

$8.1513 |

$26.66 |

-36.11% |

| November, 2029 |

$2.4711 |

$1.8811 |

$21.00 |

-90.59% |

| December, 2029 |

$91.09 |

$2.5161 |

$57.30 |

+247.01% |

Soxl Stocktwits – Direxion Daily Semiconductor Bull 3 X Shares Stock (SOXL) Price Forecast for 2030

Direxion Daily Semiconductor Bull 3 X Shares Stock (SOXL) is expected to reach an average price of $69.74 in 2030, with a high forecast of $131.81 and a low forecast of $7.6721. This signifies an +165.68% surge from the last price of $26.25.

| Month |

Average |

Low |

High |

Change from today’s price |

| January, 2030 |

$126.27 |

$116.35 |

$131.81 |

+381.03% |

| February, 2030 |

$83.28 |

$101.56 |

$103.61 |

+217.27% |

| March 2030 |

$87.34 |

$76.24 |

$72.17 |

+232.73% |

| April 2030 |

$85.01 |

$101.70 |

$84.70 |

+223.85% |

| May 2030 |

$66.27 |

$66.02 |

$65.55 |

+152.45% |

| June 2030 |

$36.80 |

$61.46 |

$56.51 |

+40.20% |

| July 2030 |

$18.43 |

$9.8218 |

$20.72 |

-29.78% |

| August, 2030 |

$47.57 |

$7.6721 |

$51.14 |

+81.21% |

| September, 2030 |

$55.41 |

$36.98 |

$67.45 |

+111.08% |

| October, 2030 |

$90.75 |

$17.81 |

$107.50 |

+245.71% |

| November, 2030 |

$102.58 |

$36.42 |

$107.83 |

+290.79% |

| December, 2030 |

$137.25 |

$124.36 |

$123.79 |

+422.87% |